Irs Schedule E 2024 Rental Property – Taxpayers could have started filing their taxes for the 2023 tax year on Jan. 29.. You can use the schedule chart below to estimate when you can expect to receive your refund based on when you . However, the deadline for residents of Maine and Massachusetts is April 17, 2024. The tax brackets that apply to your 2023 tax return, based on the filing status you use (e.g., single If you .

Irs Schedule E 2024 Rental Property

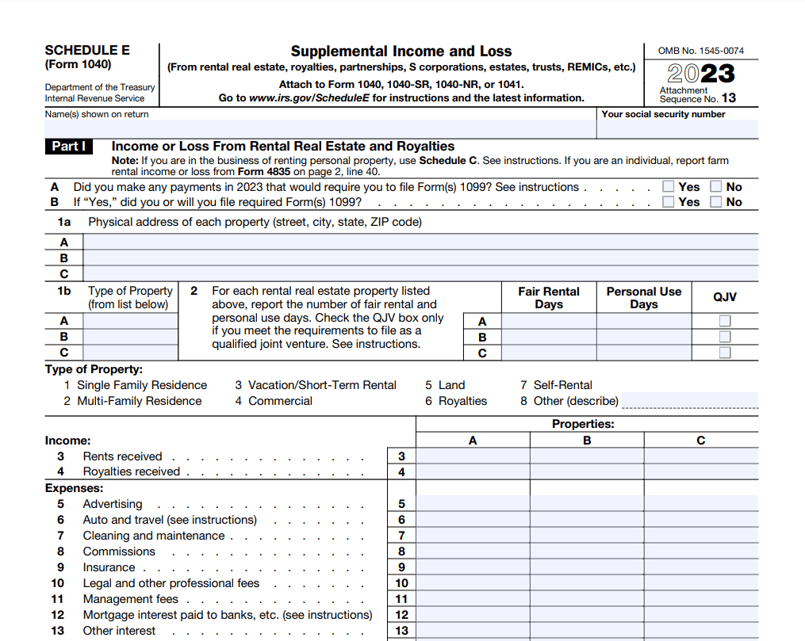

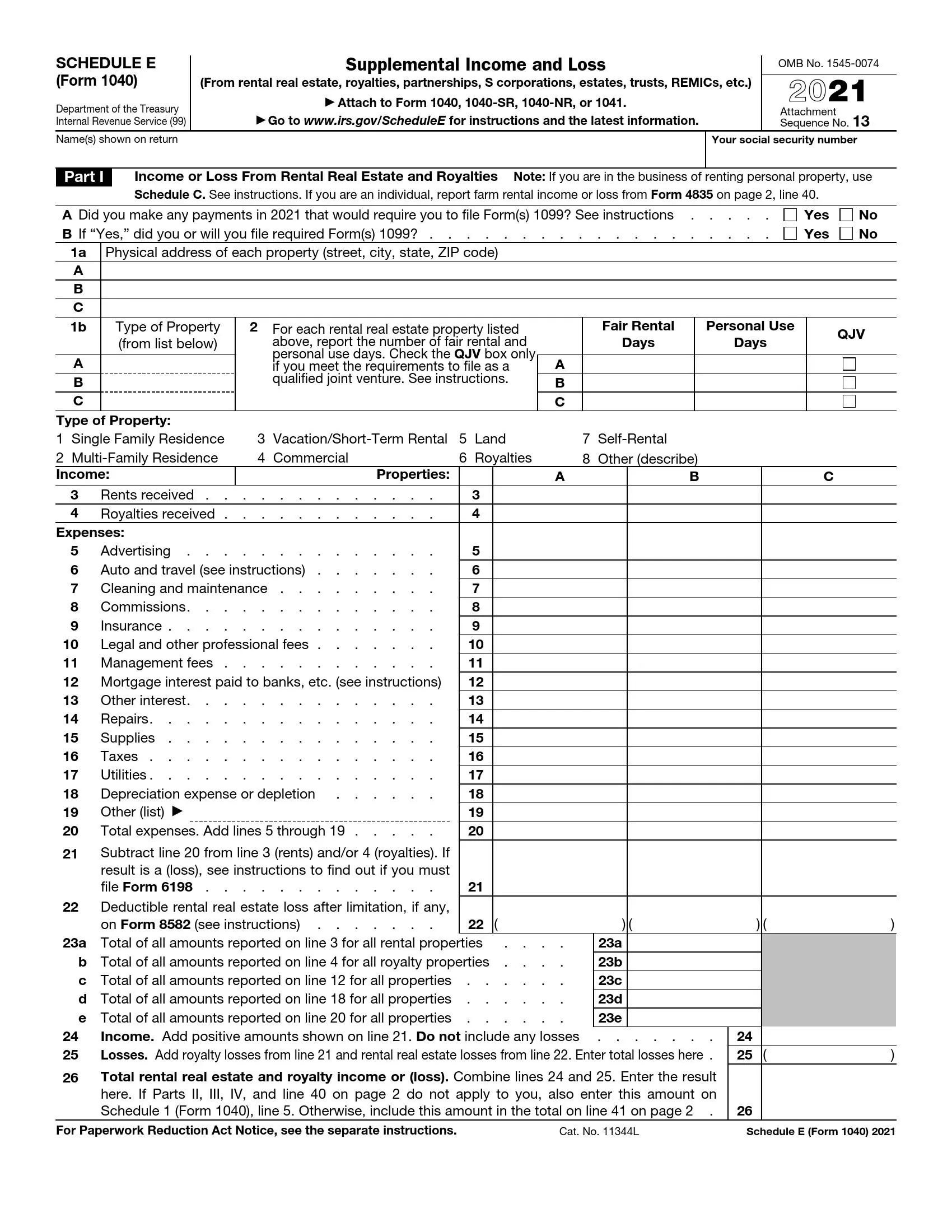

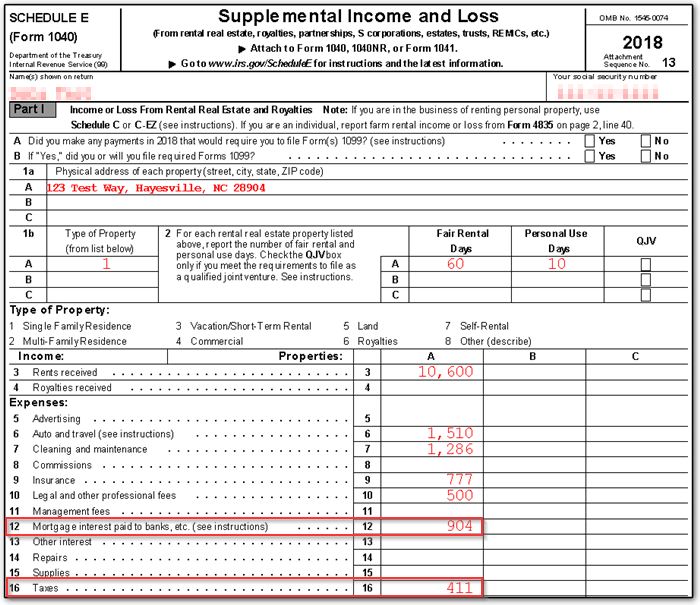

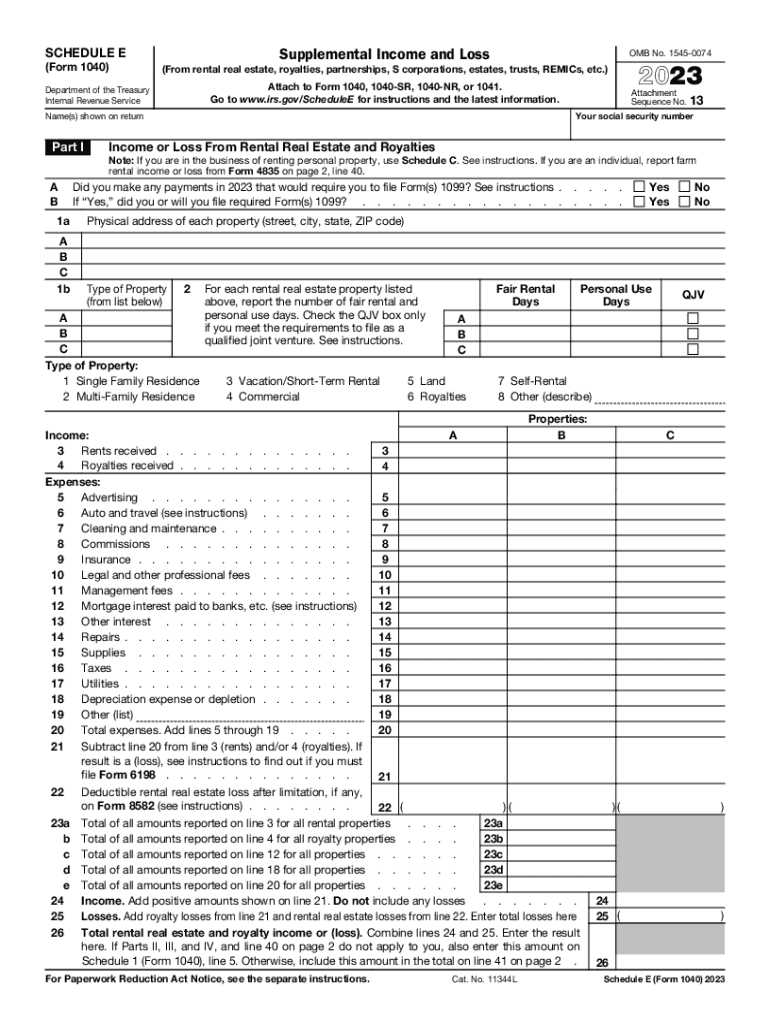

Source : www.therealestatecpa.comIRS Schedule E Form 1040 ≡ Fill Out Printable PDF Forms

Source : formspal.comUnderstanding the Schedule E for Rental Properties — REI Hub

Source : www.reihub.netThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.comRental Property Income & Expenses Spreadsheet

Source : www.fastbusinessplans.comUnderstanding the Schedule E for Rental Properties — REI Hub

Source : www.reihub.net1040 Schedule E Tax Court Method Election (ScheduleA, ScheduleE)

Source : drakesoftware.comE1204 Form 1040 Schedule E Supplemental Income and Loss (Page 1

Source : www.nelcosolutions.com2023 Form IRS 1040 Schedule E Fill Online, Printable, Fillable

Source : irs-form-schedule-e.pdffiller.comWhat Is a Schedule E IRS Form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.comIrs Schedule E 2024 Rental Property The 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors: (NEXSTAR) – Between the entertaining videos, the chance of a life hack-style discovery, and the confident delivery from self-described experts, finding advice on TikTok is both enjoyable and e . owning rental property comes with tax-deductible perks that may exceed what a filer would otherwise receive through the standard deduction. The tax deadline this year is April 15, 2024. .

]]>